Building platforms for a sustainable, resilient, adaptable future

We believe that sustainability, resiliency, and adaptation are the critical themes that will define the future of energy and infrastructure. The integration of these themes provides the foundation for Activate’s differentiated investment strategy and forms the lens through which we view and measure impact creation across our portfolio.

Focused on impactful, global megatrends

Global energy and industrial systems are refactoring around digital intelligence, resiliency, and sustainability – unlocking a supercycle of innovation driven by economic, technological, regulatory, and environmental forces.

Bringing Sustainability, Resiliency, and Adaptation Together

Activate believes economic systems must not only be sustainable but also resilient.

Global economic disruption poses one of the greatest existential threats to a successful sustainable transformation. Such disruptions could be exogenous to the transformation or a byproduct of it and may derail the project. For instance, the adoption of electric vehicles (EVs), which leads to global conflict due to scarce resources, could delay timely deployment or render the transition infeasible.

Low- and zero-carbon energy solutions must be coupled with reliability and affordability, or countries may revert to traditional forms of energy and abandon commitments to carbon reduction. Declines in population and productivity threaten to bring about long-term inflation and stagnation that will inhibit governments’ ability to make critical capital investments if they are not countered with breakthroughs in production efficiencies. Success is not inevitable.

We partner with portfolio companies:

“Activate Capital has been a true partner. Whether it’s providing capital to solve the world’s most pressing challenges, facilitating strategic opportunities, or simply acting as a sounding board, Activate has been an extremely valuable partner for Tomorrow.io.”

Shimon Elkabetz, CEO, Tomorrow.io

Rapid decarbonization of industrial and infrastructure systems

- Power

- Produce

- Move

- Adapt

Power

Global power consumption is projected to triple by 2050 as living standards increase and key industries, including transportation and manufacturing, rapidly electrify. Future energy investments will be driven by renewables and other decarbonization technologies, which are expected to become the largest source of electricity by 2025. Beyond expanding clean energy availability, solutions are emerging around managing intermittency as well as driving energy efficiency opportunities to reduce overall demand. We invest in all areas of new energy, including technology, software, and business model innovation.

- Decarbonized generation

- Affordable energy

- Resilient, flexible grids

- Intelligent assets

assets operating and serving customers, communities and the planet

Produce

Manufacturers are reassessing supply-chain resiliency and speed to market, automation, and digitization, while the drive for greater sustainability is changing how goods are produced. In the face of increased connectivity and data volume, robotics and AI are emerging to drive step-changes in productivity and, in turn, resource efficiency.

- Circular value chains

- Intelligent automation

- Secure operations

- Reshoring manufacturing

CBP agents using Altana daily

Move

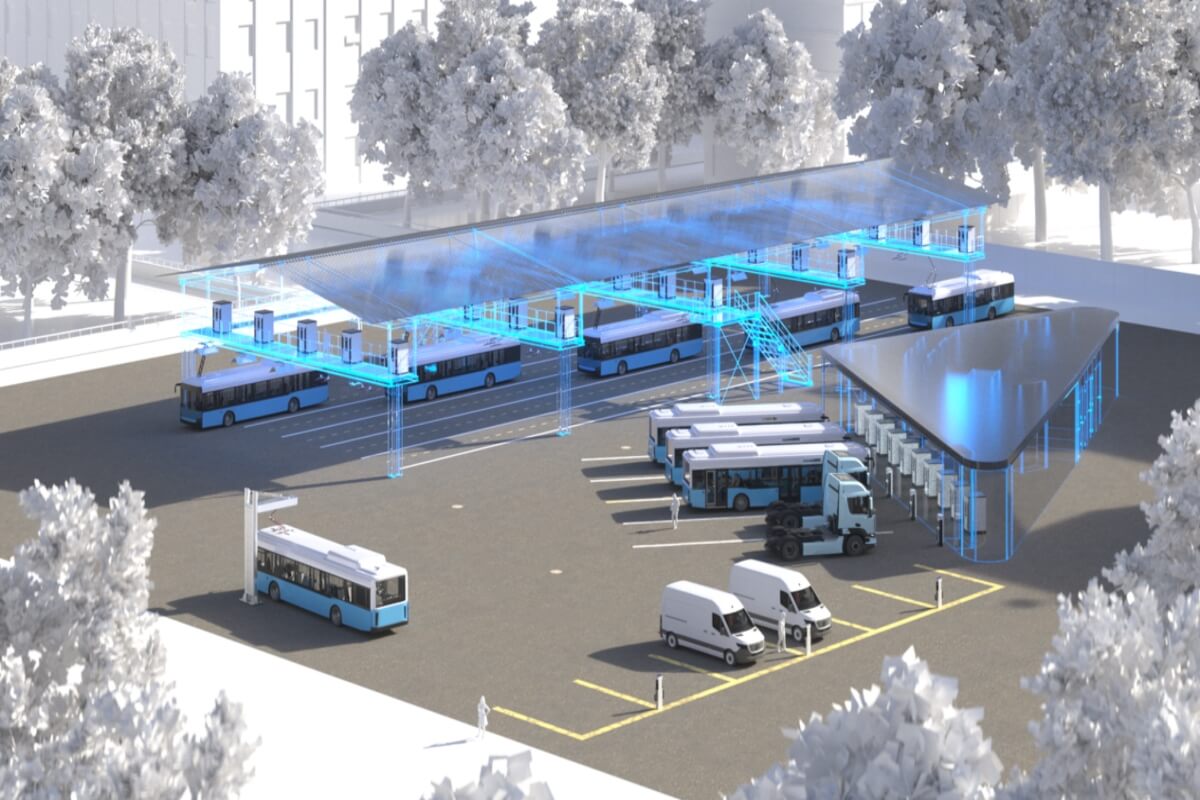

The movement of people is undergoing fundamental transformations as vehicle electrification emerges as a defining megatrend. Data and intelligence are becoming more critical to managing congestion and emissions.8 The movement of goods is also transitioning towards supply chain resilience, transparency, compliance, and sustainability.

- Circular value chains

- Intelligent automation

- Secure operations

- Reshoring manufacturing

EVs enrolled on WeaveGrid's Platform

Adapt

Against the backdrop of expanding climate impacts, adaptation will be a fast-growing area for investment. If decarbonization is the new industrialization, adaptation is the new modernization. It is essential to take measures to adapt existing infrastructure to function effectively in a changing climate. While our adaptation strategy is nascent and evolving, example metrics to measure impact within it include the number of homes adapted to withstand the effects of climate change, and the dollar value of assets protected.

- Built Infrastructure

- Weather Intelligence

- Insurance

- Economic Hardening

policyholders

View Activate Capital's impact

ImpactWhy does this company matter? Does it make the world a better place?

We believe that sustainability and resiliency are critical properties that define the future of energy, infrastructure, and our broader systems of production, transportation, and trade, which work together to mitigate the effects of climate change.

Sound economic investing across our target sectors is key to driving further capital flows. This belief grounds our conviction that working towards sustainability and measurable impact fully aligns with generating best-in-class economic returns.

We're investors, operators, and believers. Our superpower is our team.

Beyond persistence, candor, and humility, our team brings a diverse set of skills, styles, and experiences that inform our collective perspective. We focus on learning every day from our exhaustive research, companies, and each other. We embrace challenging conversations, question all assumptions, and believe the best ideas rise in a flat, intellectual environment. Activate’s Executive and Strategic Advisory Boards, comprising industry experts, executives, investors, and operators, bring another layer of valuable insight, perspectives, and networks to bear.